How does the brain respond to prices and packaging of meat alternatives?

Commissioned by ISMI (International Shopper Marketing Institute), we conducted this exploratory study to investigate how consumers' brains intuitively respond to the prices and packaging of various meat substitutes.

Consumers' willingness to pay was measured using EEG technology. During the study, participants were shown images of meat alternative packages with different prices on a computer screen. For each price, they had to quickly indicate whether they thought it was "expensive" or "cheap." While performing this task, participants' brain activity was recorded using EEG, which measures the electrical currents on the brain’s surface. This allowed us to capture participants' intuitive brain responses at each price point. These measurements resulted in what we call the "Feel Good Price," a metric that predicts expected demand, revenue, and profit for different pricing strategies.

The study included three distinct packaging designs for meat substitutes at varying price points: a regular design, a sustainable design, and a premium design (see below). The packages were unbranded and designed to closely resemble private-label vegetarian burger products from two major Dutch supermarkets, Albert Heijn and Jumbo.

Results

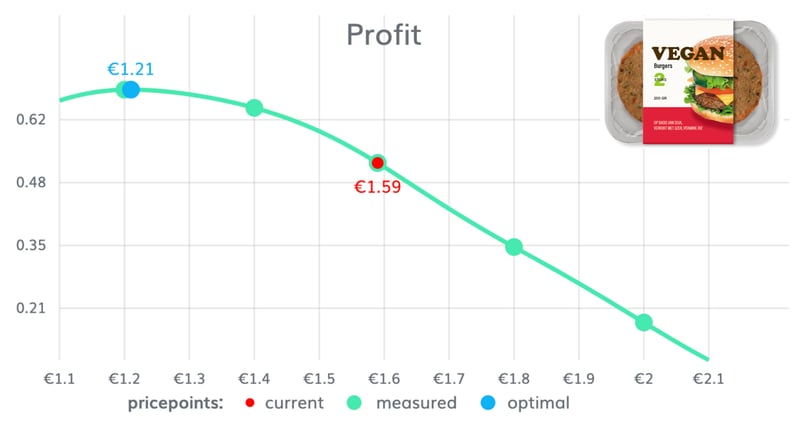

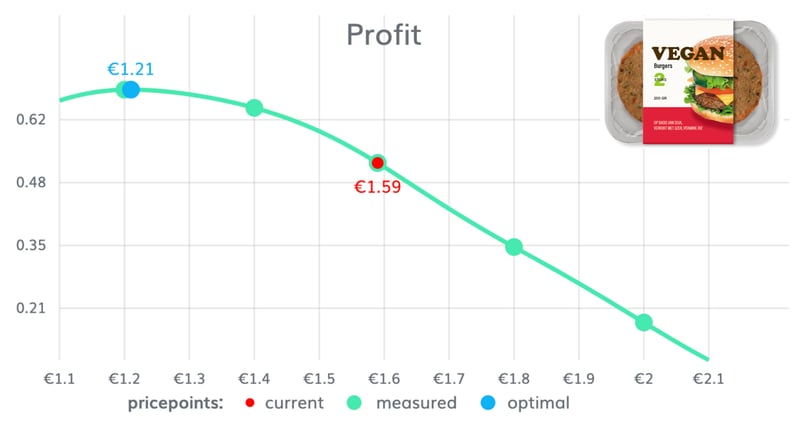

We began by using the current retail price for meat alternatives at Albert Heijn and Jumbo: €1.59. This was anticipated to be a suitable price for a regular packaging design. Using this price, along with others, we calculated the Feel Good Price and created the demand curve.

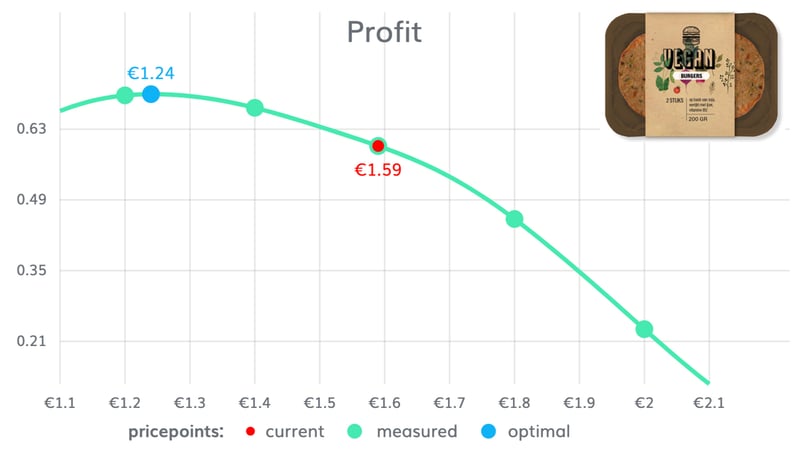

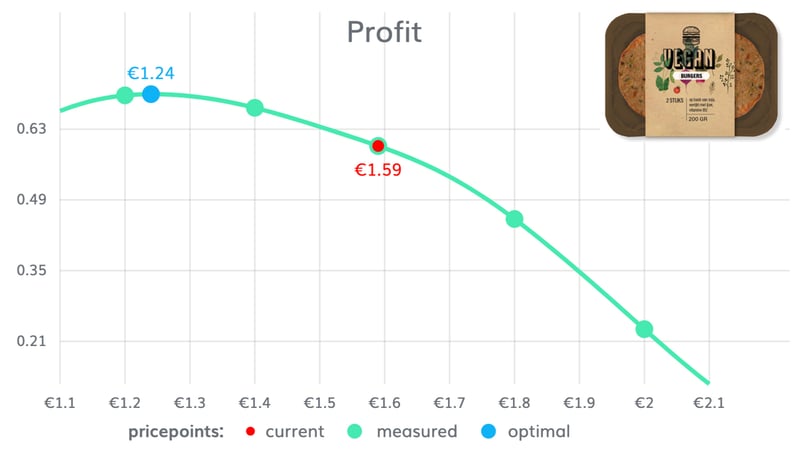

From the demand curve, we derived the expected revenue curve, estimated variable costs, and computed the expected profit curve. The profit curve revealed that the maximum expected profit for both the regular and sustainable packaging designs could actually be achieved at prices lower than €1.59. Specifically, the optimal price for maximum profit was €1.21 for the regular design and €1.24 for the sustainable design (see below).

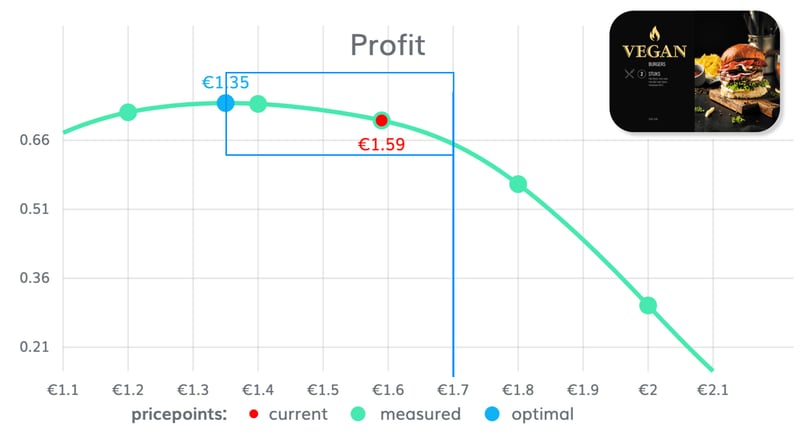

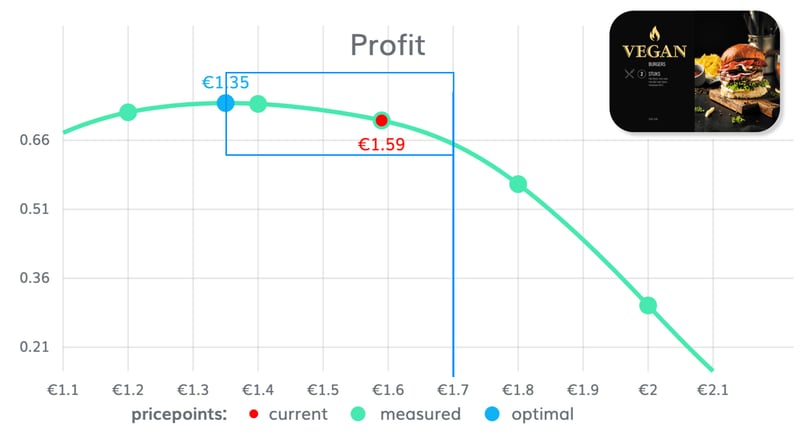

In contrast, the optimal price for maximum profit with the premium packaging design was €1.35. Interestingly, the price could be increased to €1.70 without significantly reducing expected profits, as the profit curve remains relatively flat up to that point. Based on this finding, we concluded that only meat alternatives with premium packaging designs are capable of achieving profits close to the maximum at the current private label price of €1.59 (as seen at Albert Heijn and Jumbo).

Conclusion

Our research reveals that a price of €1.59 is too high for meat alternatives in regular packaging. Since the regular packaging closely resembles the private label meat alternatives offered by Albert Heijn and Jumbo, this suggests that the current retail price of €1.59 is too high for private label products. According to the findings of this exploratory study, reducing the price by 38 cents could actually increase profits by 30%.

As meat alternatives play a vital role in contributing to a more sustainable world, their success benefits both consumers and suppliers. Consumers seek an affordable product, while suppliers require healthy margins to enable further development.

At a price lower than the current level, more meat alternatives would be sold—so much more that total profit contributions would increase, even if the profit margin per unit is slightly reduced. Furthermore, premium packaging enhances the perceived value of the product, further driving demand.

In conclusion, we recommend charging €1.59 only when the product is packaged in premium packaging.